Belgium shows the smallest increase of new EV registrations in recent years compared to the other European countries. As a result, the average annual growth in market share of EV registrations in Belgium has been a mere 14.3% over the past three years.

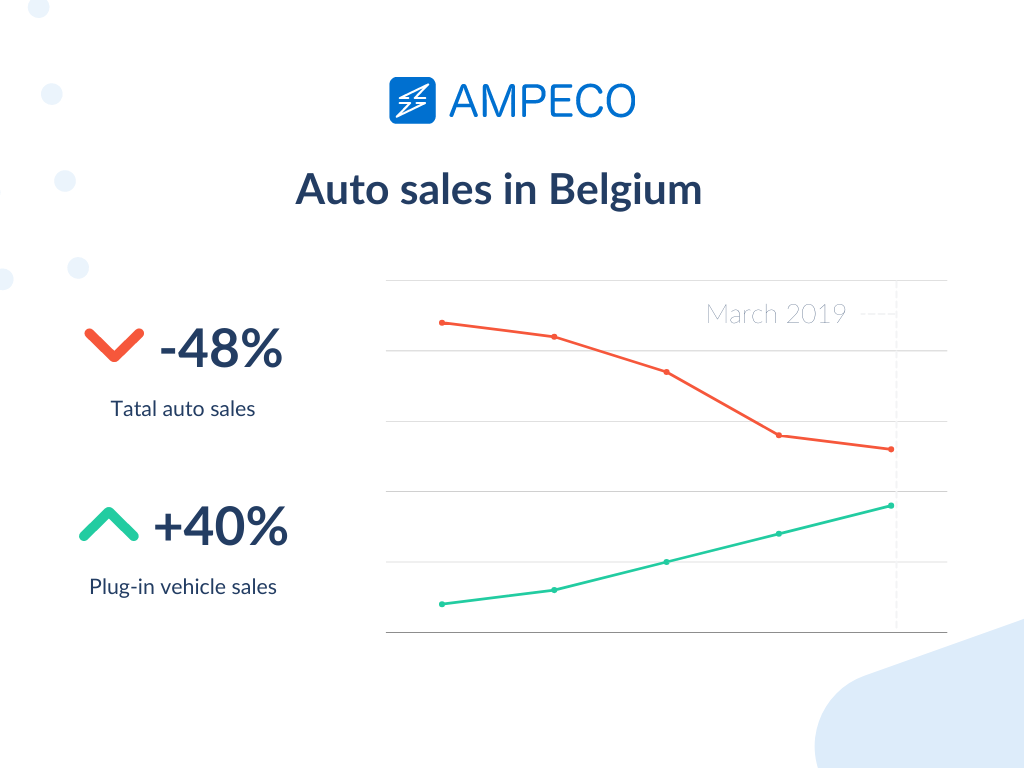

In March 2019, Belgium’s auto sales dropped by 48%, whereas plug-in vehicle sales rose by almost 40%. This trend in electric vehicle sales now puts the PEV market share at just under 14,3% in Belgium, nearly quadrupling their 2019 PEV market share (roughly 3%).

From 2017 until 2020, the evolution of a charging infrastructure has largely remained stagnant, while many other European countries have done the work. For example, if we compare Germany and Luxembourg with Belgium, we can see a well above 40% growth, while The Netherlands has seen its electric vehicle registrations catapult to an astounding 174%.

The Belgian and European capital Brussels has around 200 fully public charging stations with around 250 more to come. That even sounds kind of funny if we compare it to other European cities such as London, Amsterdam, Rotterdam, and many more, which have thousands of public electric vehicle charging stations already available.

The aim for Brussels is to get 11,000 EV charging points by 2035.

In most Belgian cities, governmental and municipal agencies are doing little to help accelerate electric vehicle adoption through charging infrastructure. In the worst-case scenario, they will work towards banning cars from cities altogether. In the best case, they will aid installations by private businesses. The Belgian government has largely halted what little EV incentives they offered in the past. Almost 53% of Belgian consumers think that taxes and subsidies for different fuel types are so unclear that they might stop purchasing an electric vehicle.

The lack of a single source of information for the number of public and semi-public charging points in the country is another issue with the general opinions on EV adoption.

Electric vehicles in Belgium are among the most expensive in Europe.

Many politicians publicly welcome the advent of EVs but are hesitant to perform any particular implementations consistent with this narrative.

The Covid-19 crisis hit, which significantly affected the EV ecosystem and the automotive and mobility market. Operations are slowly resuming, and frameworks are being put into action to deal with a potential second wave. However, the consequences of this crisis (among others, the significant drop in oil prices) on the evolution of EV mobility are still uncertain.

As of October 2020, Belgium had 7059 charging points (of which 409 are fast-chargers). This number includes semi-public charging points. As for fully accessible public charging points, the ratio for Belgium is around 500 EV charging points per 1mil citizens, which is somewhat higher than France.

There are also notable discrepancies between different regions and cities in Belgium. For example, Flanders is massively ahead of Wallonia in terms of EV charging infrastructure. Flanders has almost 9 out of 10 EV charging points in the country.

Belgium is unique because more than 60% of its households have their driveway, on which citizens could easily install a private EV charging point. In the Netherlands, this is just 9%, yet its electric vehicle adoption rate is more extensive than that of Belgium.

We have talked about some government issues, but the role of companies in the electric vehicle adoption process is shifting as well. For example, in Belgium, company cars are much more widespread than in many European nations, providing an extra facilitating entry-point.

The Cronos Group (Belgium’s largest IT company) has set an example by gradually transitioning its entire fleet to EVs. As of July 2021, they have around 200 fully electric vehicles, and their parking area offers about 35 electric vehicle charging points, the largest charging area of its kind in the country.

EV Incentives in Belgium

In Flanders, up until the end of 2019, a BEV purchase could benefit from a premium of up to €4,000. However, this was scrapped in 2020, and there are currently no premiums offered at all. Furthermore, in 2019, companies could deduct 120% of their expenses for emission-free cars. In 2020, this was decreased to 100% (not a significant difference with ICE vehicles, which range from 40-100% based on their level of emissions). Flemish residents who own an EV are exempt from paying road taxes, while EV owners in Brussels and Wallonia have to pay the minimum ownership tax of €77.35 for fully electric cars.

A tax exemption applies to private businesses in the Brussels-Capital Region on taxes levied on companies for each visitor or staff parking space (€5 per M2) tax if their parking spaces are fitted with charging stations.

National EV Incentives

Tax Benefits

- Electric vehicles are free from registration tax (BIV) and annual road tax.

- Company tax only emission-free (BEVs) vehicles will enjoy 100% fiscal deductibility. With 600.000 cars and 20% of the kilometres driven, this presents a massive fleet transition opportunity.

- From 2026, only emission-free company cars will enjoy fiscal deductibility in Belgium. At the same time, deductibility rates for those cars will also go down starting in 2026. Find more about Belgium recent decision here.

You can find more information about the application here.

Local & Regional EV Incentives

Tax Benefits

Annual road tax

- Flanders: electric vehicles are permanently free from annual road tax. Until the end of 2020, this also applies to PHEVs.

- Brussels and Wallonia: Electric cars have the most economical annual ownership (circulation) tax. The drop is from €83.56 to €1,900.

- Residential market: 30% of the purchase price of an electric vehicle, with a limit of €9,190 (via taxes, not directly from invoice)

- You can find more information about the applications here.

(BIV) Registration tax

- Flanders: Electric vehicles are forever excluded from registration tax. This is valid for PHEVs until the end of 2020. In Wallonia and the Brussels Capital Region, there is a minimal registration tax of €61,50.

- Brussels and Wallonia: (BEV) Fully-electric vehicles pay only the minimum (€61.50).

- €3,500 are granted as an additional incentive, in Wallonia, for the purchase of EV using a bonus-malus system.

You can find more information about the applications here.

EV Charging Incentives

EV Charging Incentives for Businesses

- Firms operating under the corporate tax system can benefit from a 13.5% reduction in electric vehicle charging infrastructure investments – this means keeping up to €14,375.

- In Brussels companies that install EV charging units can waive up to €75 annually per vehicle on office parking spaces in tax savings.

Conclusion

Compared to other European countries, especially the Netherlands, Belgium scores relatively low, but Belgium could potentially keep up with other countries on the continent and perhaps even aspire to become an example for the rest of Europe.

In reality, Belgium possesses a very fertile soil on which EVs could flourish. Its disproportionate number of private driveways and its optimal fiscal framework for company cars offers a very opportune platform to stimulate a forward-looking EV transformation.

The latest figures from the electric vehicle auto market reveal Belgium’s incentives’ success and prosperity over the last six years and the potential for market growth in the next decade.